Quickbooks

We integrate with Quickbooks, which is an accounting platform where you are able to seamlessly send across your sales information.

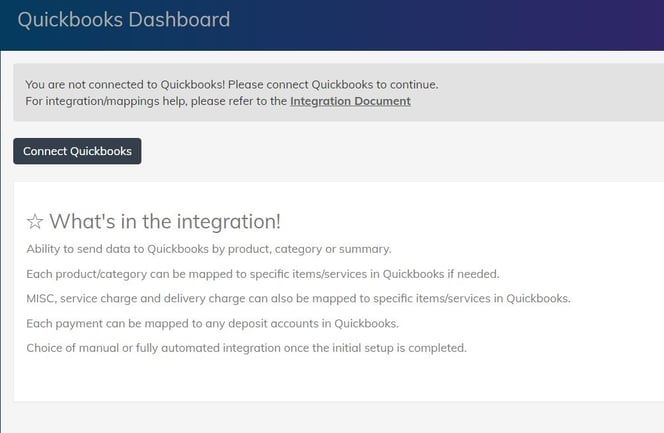

Below is what the Quickbooks dashboard looks like:

You will then be directed to the login screen for Quickbooks, which will be used to confirm the connection between both systems.

To do in Quickbooks:

- Create a Quickbooks account

- If you don’t have a Quickbooks account, then signup and login to Quickbooks. Connect your bank account to Quickbooks (not needed for SumUp POS)

- Create a Contact

- SumUp POS creates an invoice with the sales data for a period and applies the payments against it. The invoice will be created against this contact. Please note the contact can also be created on the fly in SumUp POS if you prefer - please see the “Select contact to be used” section. I

- If you have an existing contact that you want to use, skip this step.

- This can also be created on the fly in SumUp POS if you pref

To do in Good Till:

- Connect your Quickbooks account to SumUp POS

- Firstly, log in to SumUp POS back office. Then go to Apps > Quickbooks. Click “Connect to Quickbooks”.

- This will take you to Quickbooks and have you authorise the account and select a company. Once done, it will be redirected to SumUp POS.

- If you have multiple outlets and want to use the same Quickbooks organisation to send data from different outlets, you need to tick the option “Use this connection for all other outlets”. Please don’t link each outlet individually to the same Quickbooks account, as this will cause issues - just tick the “Use this connection” option on one outlet. You can still control all the individual aspects of the mappings for each different outlet.

- Select Contact to be used

- Select one from the list (this will show you all your contacts that you already have created in Quickbooks) or create one by clicking the “+ Create New” link. Please note, if you already have a contact with the same name, this might give you an error in which case just select the account from the list.

- All the invoices sent through from this outlet in SumUp POS to Quickbooks will be assigned under this contact.

- Export Type

- Select how you want the data to be sent to Quickbooks.

- We can send it “By Product” or “By Category”. If you have an Account Code assigned to a product or category, this will try to send it to that specific revenue account. Please make sure the Account Code exists in Quickbooks. If no Account Code is assigned to the product or category, it will go to the default revenue account.

- You can also send “By Summary” which will send only the VAT and non-VAT sales to Quickbooks with no specific product or category information.

- Accounts For Sales VAT (Mandatory)

- Please note this section is mandatory. Please select from the dropdown a VAT rate for each VAT rate that you use. In the example in the picture above, we are only using 20% VAT, No VAT, and 5% VAT on our products, so these are the fields we have filled out. If we were using 15% VAT we would need to fill this field out as well.

If the correct VAT rate doesn’t appear in the dropdown, please check that you have the VAT rates set up correctly in your Quickbooks account. If you add a new VAT rate in Quickbooks, please note you may need to refresh this Settings page in SumUp POS to see your changes.

- Please note this section is mandatory. Please select from the dropdown a VAT rate for each VAT rate that you use. In the example in the picture above, we are only using 20% VAT, No VAT, and 5% VAT on our products, so these are the fields we have filled out. If we were using 15% VAT we would need to fill this field out as well.

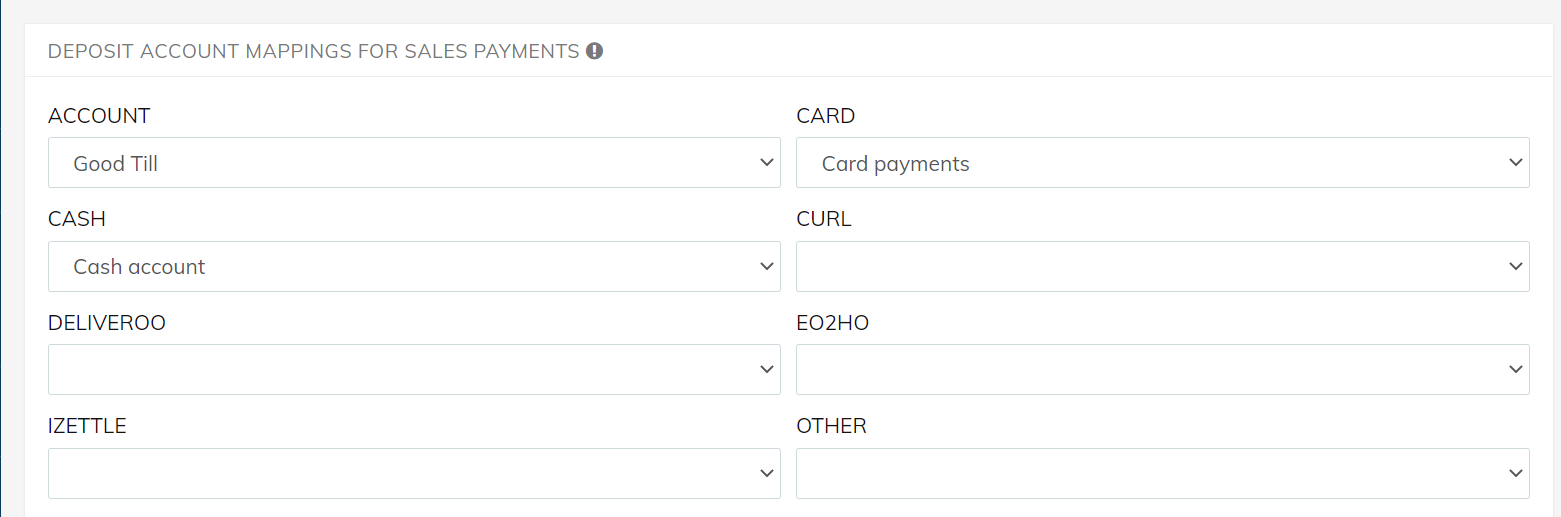

- Deposit Accounts For Sales Payments (Optional - Recommended)

Please select from the dropdown a specific Account for each type of payment that you use. In the example in the picture above, we are taking payments through card, cash and account. If we were also taking Zettle payments, then we would need to fill this field out as well.

Only the mapped methods of payments will be sent through to Quickbooks, anything left blank will be ignored. For example, if you leave all fields blank, no payment information will be sent against the invoice and the whole invoice will be overdue.

If the correct Account doesn’t appear in the dropdown, please check that you have the Account set up correctly in your Quickbooks account. Please make sure the Accounts that you choose here have payments enabled to them.

If you add a new account in Quickbooks, please note you may need to refresh this Settings page in SumUp POS to see your changes.

Your accountant may advise you better on which Accounts to use.

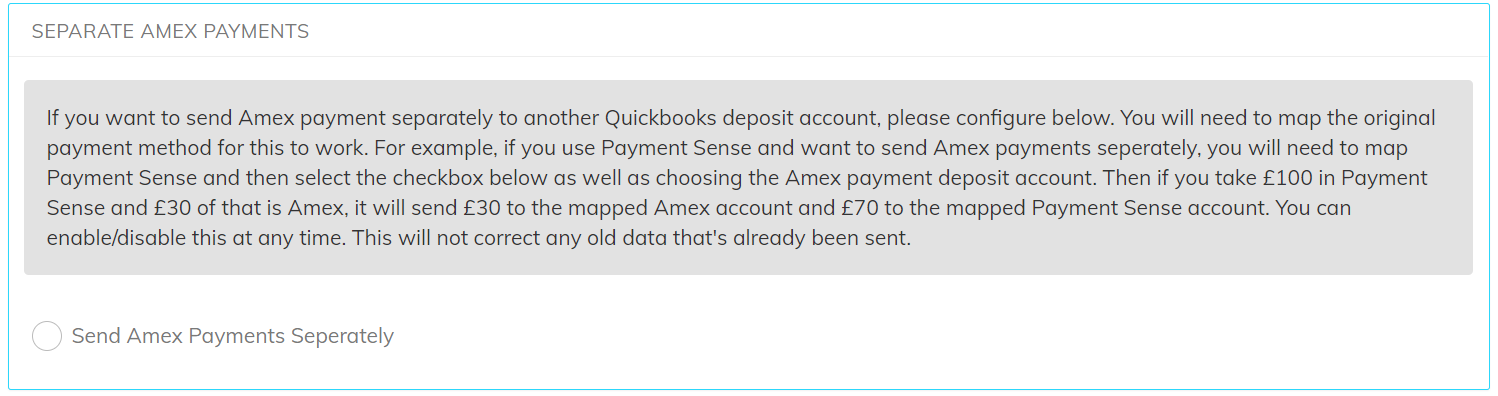

6. Separate Amex Payments (Optional)

If you want to send Amex payments separately to another Quickbooks account, please configure this here. You will need to map the original payment method for this to work. For example, if you use PaymentSense and want to send Amex payments separately, you will need to map PaymentSense (see above) and then select the checkbox for “Send Amex payments separately” as well as choosing the Amex payment account from the dropdown.

What will happen we send data across is if you take £100 in PaymentSense and £30 of that is Amex, it will send £30 to the mapped Amex account and £70 to the mapped PaymentSense account. You can enable/disable this at any time. This will not correct/backdate any old data that's already been sent.

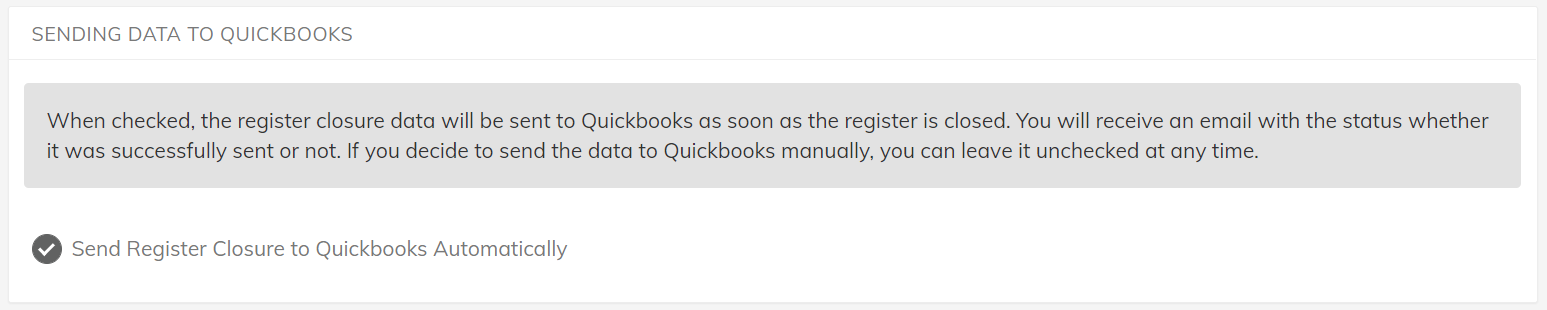

7. Sending SumUp POS Data to Quickbooks

There are two ways to send your data to Quickbooks:

Automatically:

The register closure can be sent to Quickbooks automatically whenever the register closes. The invoice date will be set as the current day. Please choose this option to send it automatically. This will also send an email to the main contact to confirm whether or not the data has been sent successfully. If it’s unsuccessful the email should detail any reasons why.

When this option is disabled, any future register closures won’t be sent until it’s enabled again. You will have to send all the register closures manually while it’s disabled. Please note that this will enable automatic data sending going forwards - it won’t backdate any previous register closures - please see the manual section below for how to backdate.

Manually:

In the back office, go to Reports > Register Closures. Select a date range and this will display all register closures within these periods.

Click on a record to see more information about the register closure. This will also display if it has already been sent to Quickbooks (by showing a little tick at the end of the row). You can then send the report to Quickbooks manually by clicking the “Send to Quickbooks” button at the bottom of the register closure report. Choose an invoice date and select send. It will give you a success/failure response.

This feature is useful if you have turned off automatic sending, as you can verify the data before pushing it to Quickbooks, or (even if you have Automatic sending on) if you need to backdate any register closures.

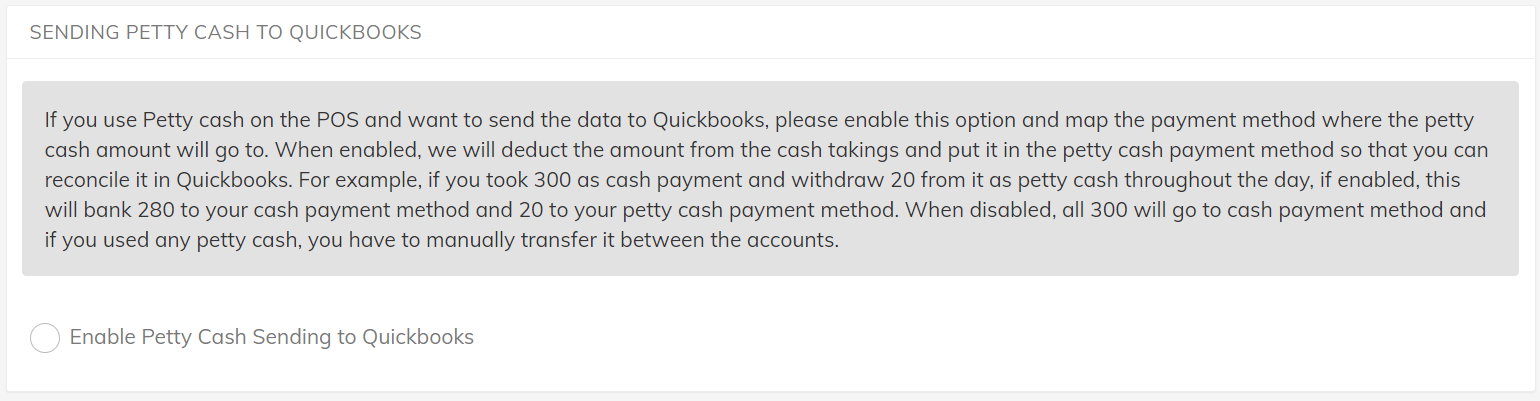

If you use Petty cash on the POS and want to send the data to Quickbooks, please enable the option and map the account to where the petty cash amount will go to. When enabled, we will deduct the amount from the cash takings and put it in the petty cash account so that you can reconcile it in Quickbooks. For example, if you took 300 as cash payment and withdraw 20 from it as petty cash throughout the day, if enabled, this will bank 280 to your cash account and 20 to your petty cash account. When disabled, all 300 will go to the cash account and if you used any petty cash, you will have to manually transfer it between the accounts.

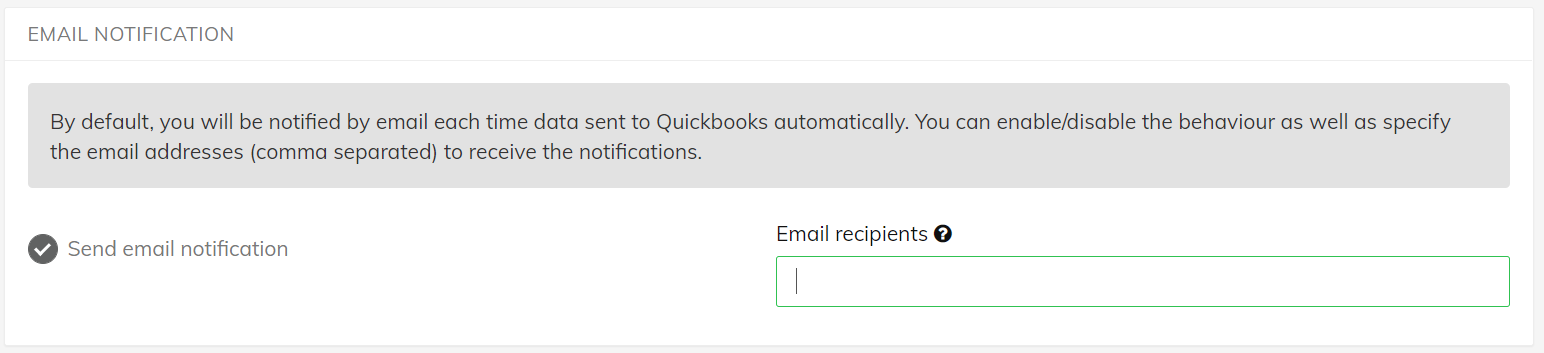

9. Email Notifications

Here you can enable the email notifications. This is highly recommended as it will send an email every time we try to post the information Quickbooks - and if it fails it will email you to warn you with the reason why.

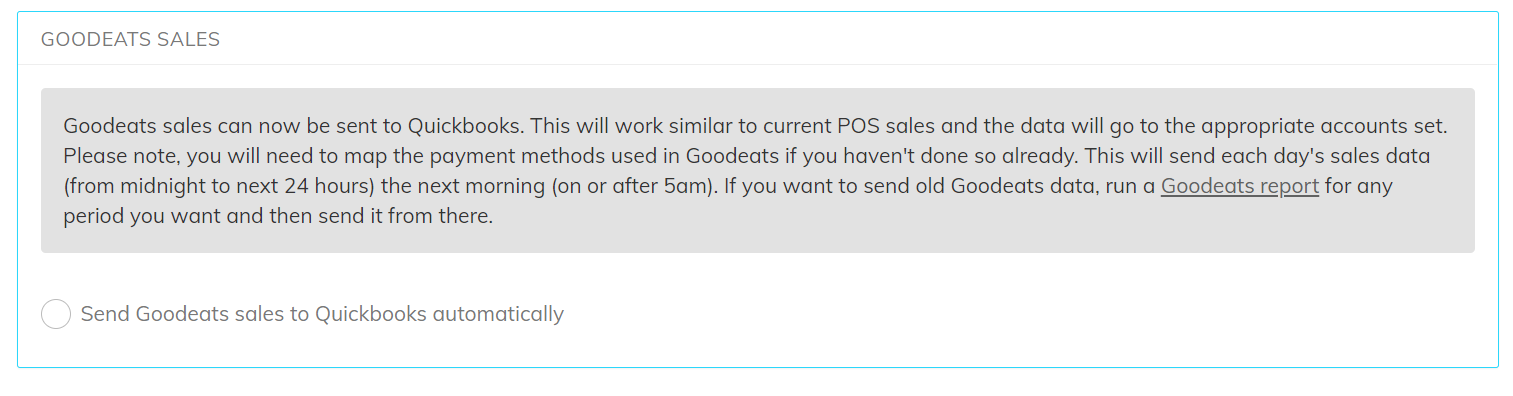

10. Goodeats Sales

Here you can choose to send Goodeats sales to Quickbooks. They won't automatically be sent with the register closure - you will need to enable this section if you want the information to be sent.

This section will only appear if the outlet has Goodeats initialised. If you need to send historic data to Quickbooks, you'll need to go to Reports > Goodeats Report, run the date range, scroll down to the bottom and select Send to Quickbooks. You will need this section enabled first to be able to do this.