I need to add a new VAT rate into the system

In the back office, go to Setup > VAT rates. (If you don't see this section you may not have the correct authorisation, please contact your account owner).

I need to see the products being sold a "x" VAT rate

In the back office, go to Products > Product List > Select the VAT rate from the dropdown.

My product is being sold at the wrong VAT rate

The most common reason for this is that the VAT rate has been set for the parent product not the variant. You'll need to edit the variant to apply the right VAT rate going forwards.

Please note it's not possible to backdate these VAT changes in order to correct historical sales.

I need to change the VAT rates for my products

You can do this in the back office by going to Products > Product List > edit the individual product (ensure if the product has variants that you're editing the variant directly).

If you want to make a bulk change to your products' VAT rate, then please email a request to pos.support.uk.ie@sumup.com, and include your company name and outlet(s) that require the change. The support team will then prepare a document containing an export of your product details and share it with you, and ask you to mark which products need changing. Once you confirm these, the support team will be able to make a bulk change in your system.

How do I apply a different VAT rate on takeaway?

Firstly, ensure that you have this function enabled on your back office by going to Settings > Global Settings > Enable Eat-in/Takeaway Product option > Save.

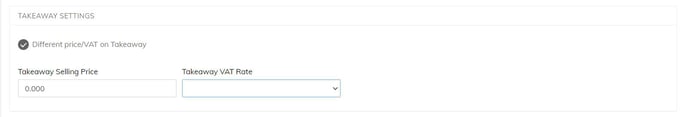

Then go to edit your product. You’ll see midway down the page a section for takeaway settings:

You can now choose to have a different price and VAT rate on takeaway.

On your till, you’ll need to enable the eat-in/takeaway feature as well. You can do this by going to the cog at the top right > Settings > General Settings > Enable Eat-in/Takeaway > Enable Prompt. This will now allow you to tell the system whether the items in the sale are for eat-in or takeaway, and the system will then apply the VAT rate accordingly.

How can I set a different VAT rate for products ordered through Goodeats?

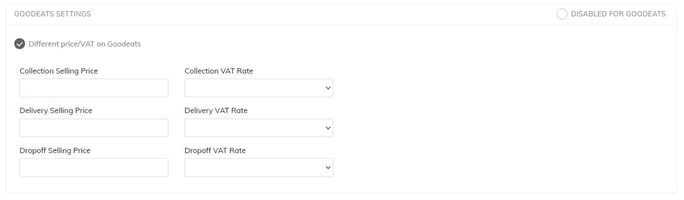

If you go in to edit your product, midway down the page you’ll see a Goodeats settings section:

Here you can select a different price and VAT rate for products bought through the Goodeats platform.

Here you can select a different price and VAT rate for products bought through the Goodeats platform.

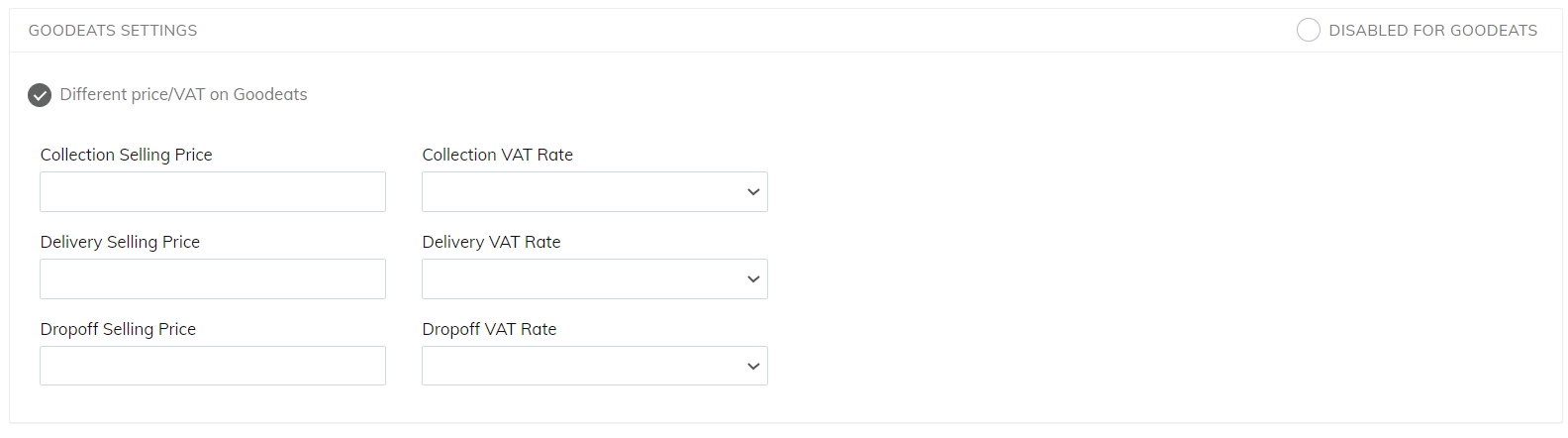

For items ordered through Goodeats, how do I set a different VAT rate for items ordered through drop-off/table ordering separate to items ordered for takeaway?

In the product settings, you can select different price/VAT rate on Goodeats:

This will allow you to have a different VAT rate and price depending on the fulfilment type.

I have alcoholic drinks which are mixed with non-alcoholic options – how do I manage the VAT?

How you manage the VAT is up to you – but please see below for an explanation of how our system manages the VAT:

Example 1) 1 product called Rum & Coke – The system will apply the VAT rate for that product (usually 20%).

Example 2) 1 product called Rum & Coke, but the coke/non-alcholic mixer is a modifer – The system will apply the VAT rate for that product (usually 20%).

Example 3) Rum & Coke but split into two products; one product for rum @ 20% VAT, and another, separate product for coke @ 5% VAT – The system will apply the 20% VAT to the rum, and the 5% VAT to the coke.